Hotels in crisis: How much longer can the hospitality industry hold out?

Over the past year, hotel closures have rocked the industry. What can investors do to prevent more from being lost?

In a Deutsche Welle video released in late February 2021 on Amstel in Berlin, Alexander Licht, the managing director of the hostel, said that he needed to take out a loan that will put him back seven years financially in order to survive until September 2021. In the same segment, Michael Frenzel, the hotel manager of Hotel Palace Berlin said one of the biggest challenges facing the tourism industry in the future is the lack of skilled workers.

Many skilled workers have left the industry for more stable careers that will leave a huge barrier to reopen when lockdown restrictions are gradually lifted. His statement is confirmed by WTTC research for 2020 that states there was a net loss of 61.6 million jobs in the travel and tourism industry.

This correlates with a 41% loss of global tourism GDP from 9,170 billion USD to only 4,671 billion USD. In Germany, this translates to a loss of around 441,000 jobs and an approximate 182 billion USD loss in international and domestic visitor spending. The German Kurzarbeit system has, however, protected many jobs in the industry as people wait out the lockdowns and hope for a fast vaccine roll out. The quick actions of the German government meant that the overall loss in the industry was much lower than it could have been.

There is, however, one asset class that was able to weather the pandemic: commercial living spaces.

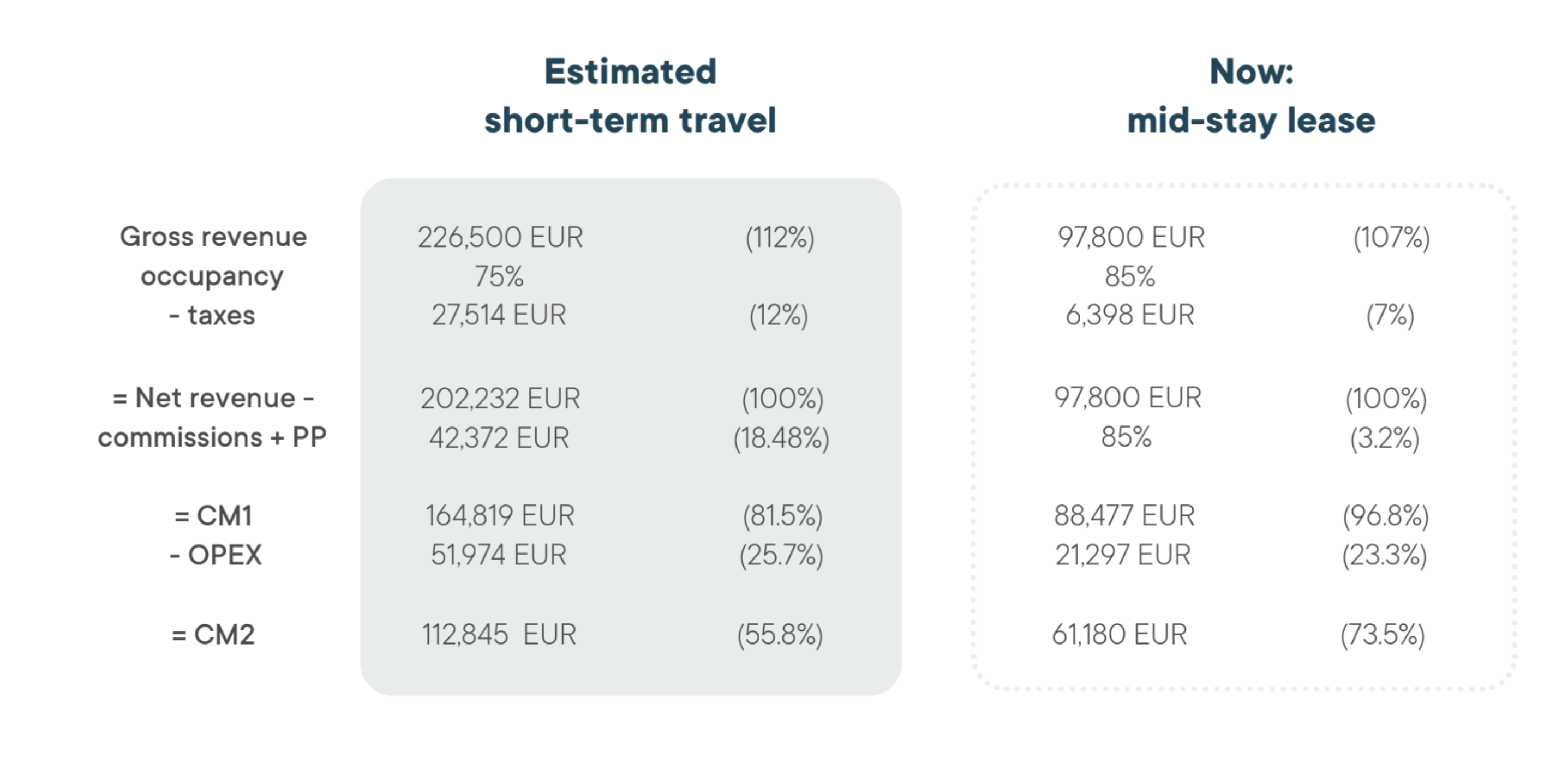

Commercial living is evaluated by the banks as residential properties, so they offer investors the stability of switching from short- to mid-stay without any legal implications. This offers the financial protection of a residential property with the profit margins of a hotel. This works seamlessly as these spaces are all fitted with a kitchenette and living space as well as the ability for tenants to get city registration which is a major problem for many moving to larger cities with limited housing options like Berlin, Frankfurt or Hamburg.

On the upside, these spaces can easily go back to short-stay when market conditions are more favourable leading to an increase in revenue.

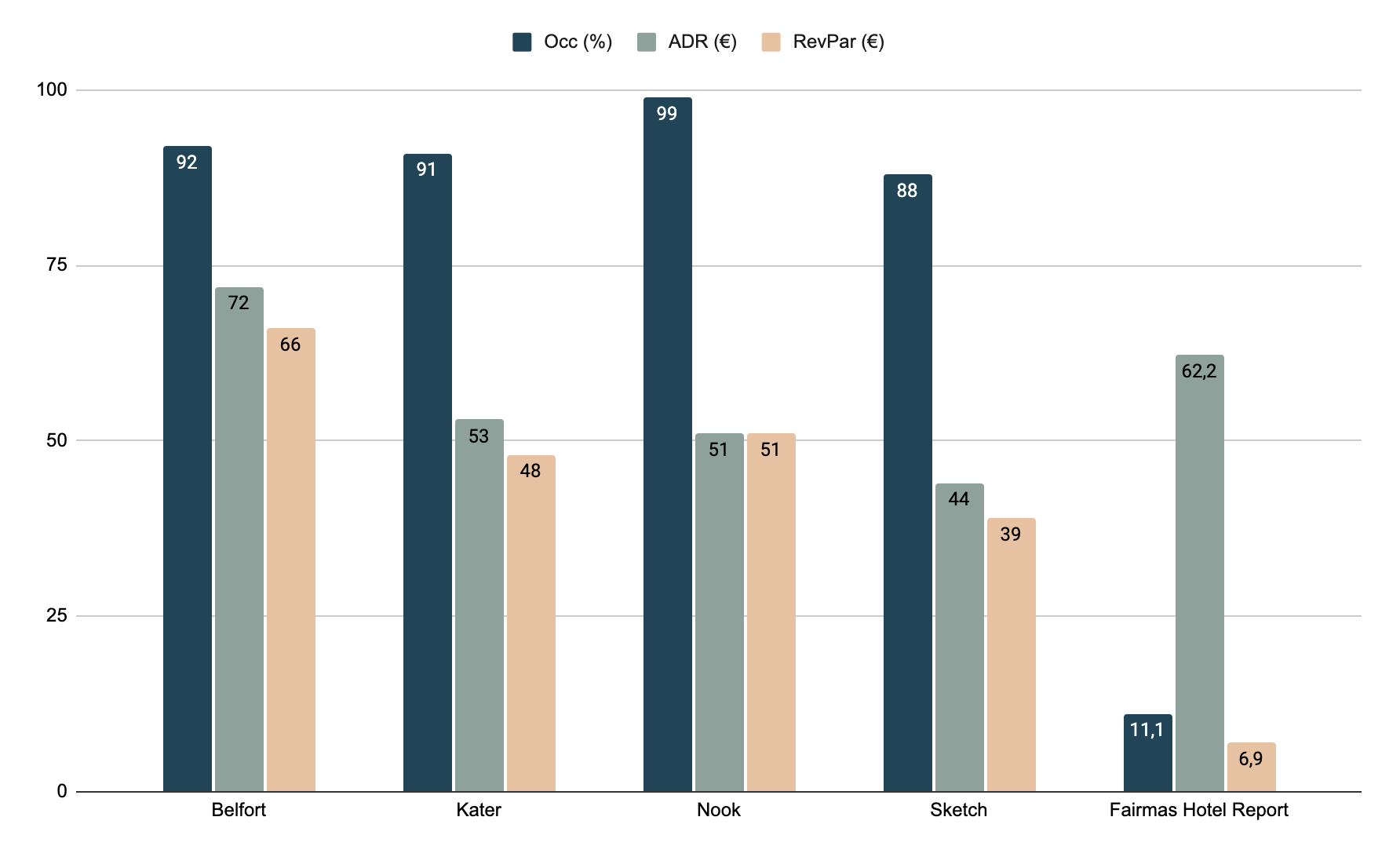

This is the case across most major European cities. Here is just an overview from our Berlin properties in February compared to the overall Berlin average.

Here, investors can see that the ADR (average daily rate) is lower for mid-stay, but just a slight decrease can lead to a higher occupancy rate as well as RevPar. Overall, this means a higher downside protection for poor market conditions that hotels are unable to tap into as their rooms tend to be smaller without the capacity for a kitchen to be installed.

Investors, who are looking for ROI on these properties, are then benefitting from both the security of a residential property and the higher profit margin of a hotel during better market conditions. A recent study has also shown that an increase in potential pandemics over the years is more likely to cause future zoonotic diseases, so an asset class that can switch flexibly between short- and mid-stay will become increasingly important.

Commercial living spaces offer investors with a variety of advantages from consistent, quality interior design, improved overall processes, reduced personnel costs, increased room sizes, kitchenettes for mid-stay flexibility and room amenities like sustainably sourced water and glass shampoo bottles.

At COSI, we’re leading the real estate market and the switch to a more reliable asset class for investors. Our concept is based on in-house technology and the drive to transform an industry.